The difference between cost center and profit center

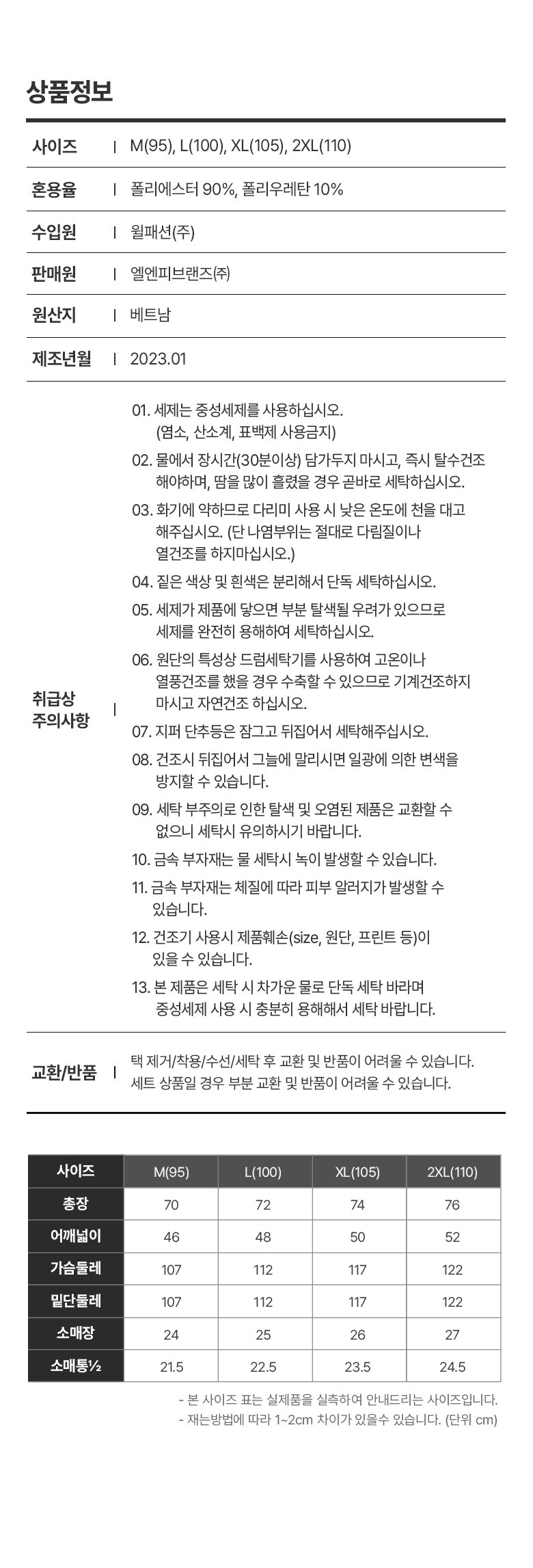

Such an activity centre comprises of location, department or an item of equipment is an impersonal cost centre. This type of activity centre comprises persons or groups thereof in connection to which costs are ascertained. In this post, you will come to know the fundamental differences between cost centre and profit centre. A centre for which cost is ascertained and used to control cost is Cost Center. Whereas a centre whose performance we can measure through its income earning capacity is Profit Center. Companies may decide it is not useful to have the expenses of a specific area segregated from other activities.

As such, they may be less effective at identifying and managing wasteful spending. The retailer is a decentralized organization and gives the managers of each department the authority to make decisions for the revenue and expenses of that department’s goods. However, managers are also held responsible for meeting a target profit set.

GoCardless integrates with over 350 partners, including leading software including Chargebee, Salesforce, and Xero, to keep your workflow organized across multiple locations and branches. In Enterprise, we have combined forces with Webfleet Solutions to offer an integrated mobile service for professional drivers and fleet managers. Together, we will offer workforce management features, best-in-class navigation for all vehicle types, up-to-date maps with live traffic information, reliable ETAs, and more. A Profit Center is a department of the company that not only adds to its Expenses but helps generate significant Revenue.

- As budgets are prepared, cost centers are intentionally forecast to operate as a loss; in fact, budgeted revenue will be $0.

- If payments aren’t properly credited to a customer’s account, there could be serious repercussions.

- When I joined JP Morgan in 2011, I expected to join a tech-first company.

- A centre for which cost is ascertained and used to control cost is Cost Center.

- A good finance and accounting department also assesses sales trends, reviews different pricing strategies, and reviews changes in the industry.

Even though your customer service department costs money rather than makes money, it also settles disputes, solves problems, and essentially keeps your customers happy. If you sell goods and services (and what business doesn’t), keeping your customers happy is essential. No, not just essential — it’s also a full-time job, which is why creating a customer service department is a worthy investment for your business. In most larger businesses, cost centers are a necessity, providing added value to a business.

We and our partners process data to provide:

It is acknowledged upfront that a cost center will be unprofitable; however, a manager can still be held accountable to the degree at which they operate at a loss. Firstly, a cost center is an area of responsibility within an organization https://simple-accounting.org/ where costs are incurred. A profit center, on the other hand, is an area of responsibility within an organization that generates revenue. Are you struggling to wrap your head around the difference between cost centers and profit centers?

The manager of a cost center is held responsible only for costs incurred by the department and not any revenues generated. Revenue is all the income generated from normal business operations such as selling goods and/or providing services. Revenues are important for a company because it is what keeps a business grant proposals or give me the money! going. Since cost centers aren’t responsible for generating any revenue, the revenue from the profit and investment centers must cover the costs of the cost center. A decentralized organization is an organization in which decision-making power is spread throughout the organization, not just top management.

Impersonal/Machinery Cost Center

Most often, operational cost centers may be seen as common company departments that group employees based on their function within the company. The important part to note is an operational cost center is a back-office function that, while it may represent an entire department, does not generate revenue. Cost centers are often assigned their own general ledger coding that management and personnel can use to absorb and report costs. As budgets are prepared, cost centers are intentionally forecast to operate as a loss; in fact, budgeted revenue will be $0. Instead, management’s goal is to minimize the deficit of a cost center while still providing general support to profit centers. A profit center is a unit of a business that is responsible for generating revenue for the business.

It also allows organizations to evaluate a specific unit within the company. It evaluates the profit and loss of individuals as well as independent areas of an organization. A service cost center groups individuals based on their function and may more closely refine the costs within a department.

Because managers take all the important decisions regarding product mix, promotion mix and technology used. At the retailer Walmart, different departments selling different products could be divided into profit centers for analysis. For example, clothing could be considered one profit center while home goods could be a second profit center. As your business grows, the bookkeeping process necessary for your small business will also grow. When growth does occur, you may want to create and manage various cost centers.

A company may be interested in only viewing the upfront cost, maintenance expenses, repair requirements, and other costs related to just the heavy machinery for a process. This type of cost center may coincide with other types of cost centers, as companies may want to know the non-personnel cost of a specific department, for example. External users of financial statements, including regulators, taxation authorities, investors, and creditors, have little use for cost center data.

Definition of cost center and profit center

What a mess it could be to compare the standards with the actual figures. Hence, the subdivision of the factory into a number of departments becomes essential. And to calculate the cost of production of the respective cost centre, all the costs related to that particular activity would be accumulated separately. While none of these tasks generates revenue, they are all essential to the health and well-being of Debra’s business. If bills aren’t paid on time, Debra’s credit rating could drop, affecting her ability to purchase goods for resellers. If payments aren’t properly credited to a customer’s account, there could be serious repercussions.

Interested in automating the way you get paid? GoCardless can help

Cost centers can also provide valuable insights into an organization’s overall efficiency. However, cost centers can also create silos within an organization, as different departments may be reluctant to share information or cooperate with one another. This article looks at meaning of and differences between two different types of units of any business – cost center and profit center. Any division of the organization that does not directly contribute to Net Profits but still generates costs while assisting key operations. The centres where the firm undertakes production or conversion activities is production cost centres.

Does a Company Need to Have a Cost Center?

They also manage employee disputes, investigate complaints, and ensure your business complies with state and federal laws. Running a cost center is a logistical burden that requires a company to perform potentially extra work to track, collect, and analyze information. Companies can opt to segment out cost centers however they choose, as the end goal of a cost center is to isolate information for better internal data collecting and reporting. Here are several common types of cost centers along with examples of each. For example Canteen, Maintenance shop, Toolroom, Accounts, Power House, etc. By breaking out cost center activities, a company can gauge the cost of administrative operating the business.

We divide the organization into various sub-units for the purpose of costing. That is the collection and utilization of cost data in an optimum manner. These sub-units are the smallest area of responsibility or segment of activity. Payroll must be processed when it’s due, taxes must be paid, and company performance must be regularly analyzed to keep expenses to a minimum while maximizing revenue. That’s why the accounting and finance cost center is so important to Debra’s business. Many years ago, Debra’s Department Store began as a small, local hardware store, but as Debra added different departments, her revenue grew.