What Are the Types of Costs in Cost Accounting?

Below is a list of functions a cost accountant is expected to perform in a company. Opportunity costs are only used when determining which option out of multiple choices of investment is most viable. Technical University of Munich (TUM) is one of Europe’s top universities.

Standard costing is a technique where the firm compares the costs that were incurred for the production of the goods and the costs that should have been incurred for the same. Installing machinery in production is a sunk cost as you cannot recover it further. Direct cost is significant because it is the easiest of the four types to allocate to specific activities or product lines, though it’s not usually the easiest place to find cost savings. The variable overhead variance is the difference between the actual variable overhead cost and the standard variable overhead cost. Cost accounting and financial accounting are two branches of accounting that track and report financial information about a business. Since the onset of the 20th century, cost accounting has become widely used for better financial management.

Efficiency variance

Check out the following sections for a complete idea of the concept and techniques of cost accounting. Indirect labor costs are costs for workers not directly involved in production or distribution. Indirect materials are the materials used in the production process that cannot be easily traced to a specific product or job.

- But if the company operates under historical accounting principles, the property will still be recorded as $50,000 on the balance sheet.

- You’ll also want to get the scoop on text-taking strategies for cost accounting students.

- Methods like Activity-Based Costing (ABC) are commonly used to identify the cost drivers in production, enabling more accurate pricing and profitability analysis.

- It is instead measured in terms of how much time customer satisfaction takes and the level of customer satisfaction.

- Cost accounting is a great tool to improve the profitability in any business.

- Activities can refer to any event or task with a specific goal, such as setting up a machine for designing products, distributing finished goods, or operating machines.

For example, the monthly rent paid for a land lease cannot change when you exceed or fall short of your target. Cost accounting is a branch of managerial accounting that is very important for budgeting. It is only after identifying where money is being lost that the company can stop non-profitable activities and expand into profitable activities. However, the electricity used to power the plant is considered an indirect cost because the electricity is used for all the products made in the plant. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Indirect Costs

It allowed railroad and steel manufacturers to control costs, become more efficient, and make better pricing, investments, and development decisions. Understanding the cash flow of your business – both in terms of incoming cash and expenditures http://design4free.org/index.php?option=com_content&id=1&limit=16&limitstart=848&task=blogcategory – is crucial if you hope to succeed in any competitive modern market. This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

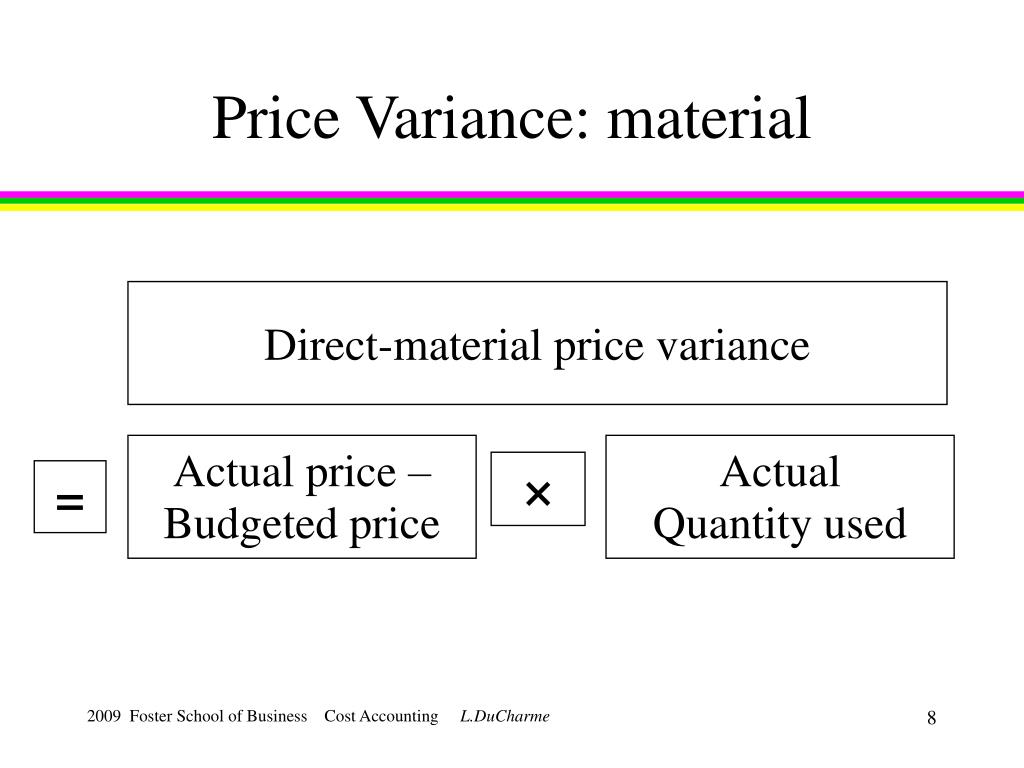

Determining costing variance allows a manager to pinpoint the particular areas where there are cost differences and the reasons for the differences. By analyzing it, the manager can know which added costs are avoidable and how to avoid them. The difference between both costs is called variance and can be positive or negative. Are you ready to transform your https://chuvash.org/wiki/Good%20Bye,%20America!%20-%20%D0%92%D0%B8%D1%82%D0%B0%D0%BB%D0%B8%D0%B9%20%D0%90%D0%B4%D1%8E%D0%BA%D0%BE%D0%B2 practice with modern technology? Wafeq’s cutting-edge solutions align with global best practices and are designed to streamline your accounting needs. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Do you already work with a financial advisor?

Lean accounting is an extension of the philosophy of lean manufacturing and production, which has the stated intention of minimizing waste while optimizing productivity. For example, if an accounting department is able to cut down on wasted time, employees http://hellbro.ru/foto-prikoly-interesnoe/1540-konkurs-mikrofotografii-nikon-small-world-2014.html can focus that saved time more productively on value-added tasks. We follow certain rules and principles to guide us in this ascertaining of costs. Some such methods of costing to ascertain these costs are historical costing, standard costing, etc.

We will sometimes just refer to product and service costing as «product costing», but of course some companies offer physical products while others offer services. We explain how companies design product costing systems and we make you familiar with important methods of product costing. We also discuss how well the costing methods are suited for different production processes and program types. To this end, we will distinguish «job shop production» and «mass and batch production». Companies may be moved to adopt ABC by a need to improve costing accuracy, that is, understand better the true costs and profitability of individual products, services, or initiatives.

It is calculated by adding the fixed cost and net target income and dividing it by the contribution margin per unit. Direct materials are the raw materials used to make a product, which can be easily traced to the finished product. For example, the wood used to create a table is a direct material, while the glue used to hold the wood together is an indirect material.

This differs from financial accounting, which must follow a set template and is used to inform people outside the company, such as investors, about its financial performance. Operating costs are the costs to run the day-to-day operations of the company. However, operating costs—or operating expenses—are not usually traced back to the manufactured product and can be fixed or variable. Cost accounting can help with internal costs, such as transfer prices for companies that transfer goods and services between divisions and subsidiaries.