How to short stocks

.jpg)

A highly volatile asset will change in value quickly, as multiple transactions in the market drive the price either up or down. Don’t worry if this seems a little confusing at the moment – all you need to remember for now is that short trading is the opposite of long trading. This means you buy the stock or currency with the intention of selling it when the price has increased.

Join the newsletter

Short selling is permitted at this point only if the price is above the current best bid. The alternative uptick rule generally applies to all securities and stays in effect for the rest of the day and the following trading session. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Please consider the Margin Trading Product Disclosure Statement (PDS), Risk Disclosure Notice and Target Market Determination before entering into any CFD transaction with us.

Since you initially sold the shares for $10,000, your loss is $4,000, not including any fees or interest accrued during the short position. Short selling occurs the book trail the liberty girls when a trader borrows a security and sells it on the open market, planning to buy it back later for less money. Theoretically, the price of an asset has no upper bound and can climb to infinity.

More reading for active investors and traders

Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. Or, if you prefer, you can then fund your account and start to place trades for real as and when it suits you.

How long can you short a stock?

They see short-sellers as not just taking advantage of a fall in price, but actively making the situation worse. Though the ‘standard’ market costs for borrowing stock tend to hover around 0.3%-3%, it’s not unheard off for costs to increase by multiple tens of percent if supply and demand within the markets shift. Unfortunately, if you hold a short position, dividends can work against you. Depending on your trading method, owed dividends may be deducted from your trading account to pay the stock owners.

Why Does Short Selling Have Negative Reputation?

If you have an open short sale on a stock, and that stock keeps going up in price, it’ll keep getting more and more expensive to repurchase the shares needed to close your short. Even the so-called professionals sometimes burn themselves with short selling. Short-term speculation is risky in general, but if you’re set on betting against a stock, perhaps consider other ways of doing so, such as buying put options on it. For active traders or investors interested in market timing, short selling is a strategy that can produce positive returns even in a period of negative returns for a stock or the market as a whole. But if you decide to short stocks, ensure you fully understand the risks and have a clear exit plan for getting out of the short if the stock price rises against you.

Yes, most exchange-traded funds (ETFs) can be shorted like regular stocks. However, because ETFs represent baskets of stocks, they may be less volatile than individual stocks, what will happen to bitcoin in 2021 which often reduces any potential for profit. The exception, though, is only for when the short selling supports liquidity in the market. By mandating firms disclose when they use this exception, the SEC aims to ensure regulators have a clearer view of when and why firms use this flexibility.

Plus, short sellers face a stock market that has a long-term upward trend, even if many of its companies do fail. Another major obstacle that short sellers must overcome is market how to buy bitcoin with credit card or debit instantly efficiency. Markets have historically moved in an upward trend over time, which works against profiting from broad market declines in any long-term sense. Not at all — there are several different ways to profit from a decrease in stock prices, including put options and inverse ETFs. Each of these has its own unique advantages and disadvantages compared to short selling.

For instance, you will be able to short major indexes like the NASDAQ or the FTSE 100 on most trading platforms. This is because there will nearly always be traders ready to buy or sell. As we’ve just shown you, shorting gives you the opportunity to profit from assets you have reason to believe are going to fall in value.

Let’s say you’ve decided to make a ‘long’ trade on Gold, because you believe the price is going to go up over the next month. If you place a trade on a particular stock, you’re doing so because you believe the value is going to go up. Get a daily email with the top market-moving news in bullet point format, for free. However, there are also inverse ETFs that go up in price as the underlying indexes go down. The prices of these ETFs move inversely to the indexes they follow. You buy the car back at the lower price of $8,000 and immediately return it to your friend.

.jpeg)

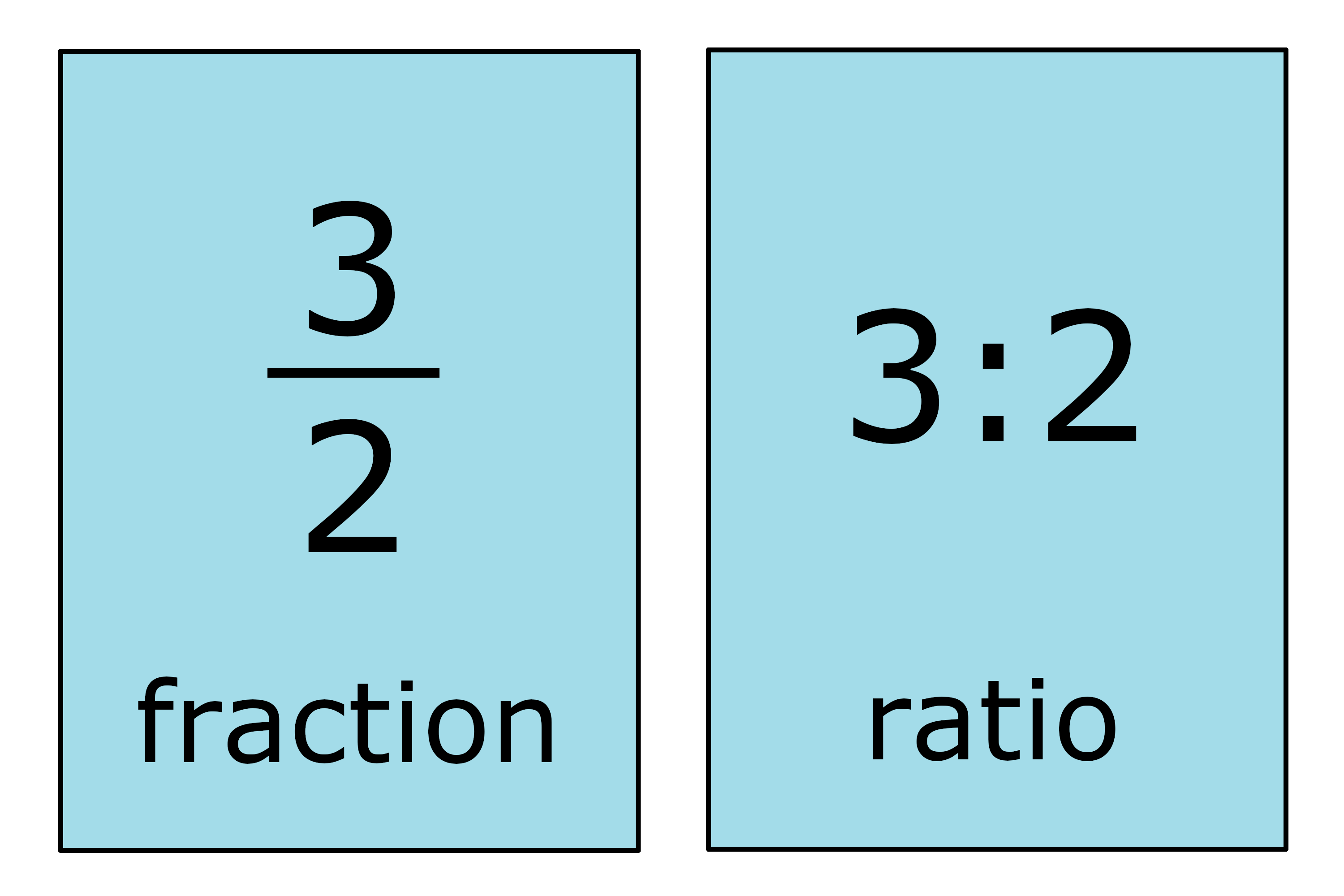

Select an asset that you think will go down in price and place a short trade (keeping your position-size small). Now you understand how short trading works, you can begin to practice some short trades. Short trading using CFDs has many benefits, but also carries inherent risks that traders should be aware of. Both long and short trading strategies are now widely used around the world by all types of traders. The theory was, unscrupulous players could sabotage a stock to reduce its value, in order to benefit short traders.

- Depending on the scale and nature of the short, it has the potential to magnify losses.

- You ‘sell’ to open your position, and then ‘buy’ to close your position.

- The difference between the purchase price and the sale price is your profit (or loss if things haven’t gone to plan).

- However, as financial markets matured, short trading stocks became an accepted trading strategy that provides valuable liquidity to markets.

- Some argue that shorting stocks serves as a “check” on overvalued companies, helping reveal true market values.

Short selling as part of a hedging strategy will help protect some gains or mitigate losses, depending on whether prices go up or down. If a stock’s price goes up instead of down, the short seller will lose money—and that doesn’t even include the fees to borrow shares that are part of this trading strategy. Selling short, as this strategy is sometimes called, is a way for traders to bet on falling prices or hedge a position. While it may sound straightforward, short selling involves plenty of risks.